2025 March Calendar Blank Form Irs

2025 March Calendar Blank Form Irs – of the Tax Code requires a withholding agent to file Form 1042 for income paid during the preceding calendar year. A withholding agent typically needs to file Form 1042 on or before March 15. Section . urges business owners to mark their calendars for the impending deadline to e-file Form 7004. The automatic business tax extension filing must be completed by March 15, 2024. To familiarize .

2025 March Calendar Blank Form Irs

Source : www.facebook.com3.11.13 Employment Tax Returns | Internal Revenue Service

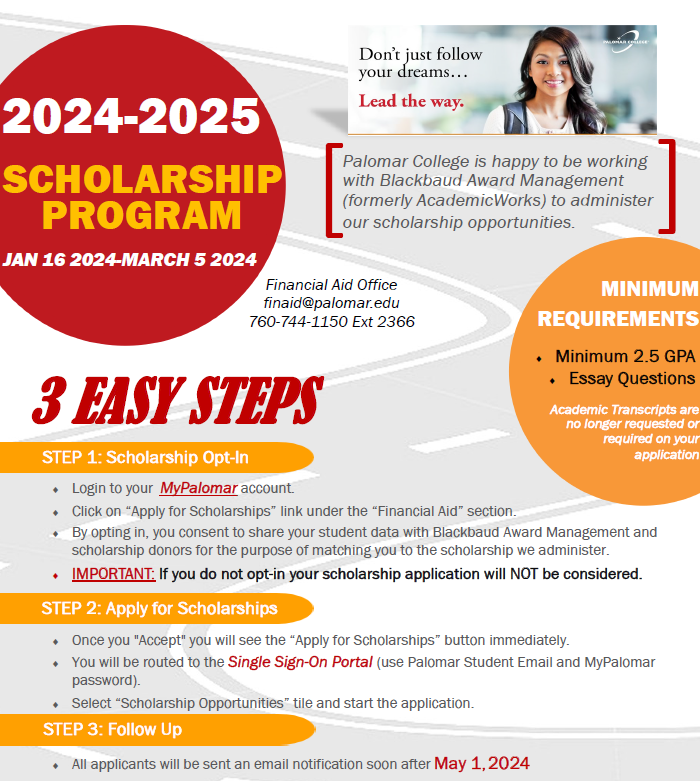

Source : www.irs.govScholarships – Palomar College Financial Aid Office

Source : www.palomar.edu3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.govPalomar College Financial Aid Office

Source : www.palomar.edu3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov2012 2024 Form USPS PS Fill Online, Printable, Fillable, Blank

Source : ps-form-2025.pdffiller.com3.11.23 Excise Tax Returns | Internal Revenue Service

Source : www.irs.gov2024 25 Biennial Budget by Pierce County Issuu

Source : issuu.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov2025 March Calendar Blank Form Irs Manay CPA, Inc. | Atlanta GA: However, companies that want to change from a calendar year to a fiscal year must get special permission from the IRS or meet one of the criteria outlined on Form 1128, Application to Adopt . The IRS requires Purdue University, as an employer, to report whether an employee and dependents (if applicable) had health insurance coverage in 2023. Therefore, employees receive Form 1095-C, which .

]]>